oklahoma franchise tax instructions

The franchise tax for corporations doing business both within and outside of Oklahoma is computed on the pro- portion to which property owned or property owned and business done within Oklahoma bears to total property owned or total property owned and total business done everywhere. The maximum annual franchise tax is 2000000.

Form 540 Fill Online Printable Fillable Blank Pdffiller

LINE BY LINE INSTRUCTIONS.

. Oklahoma franchise excise tax is levied and assessed at the rate of 125 per 100000 or fraction thereof on the amount of capital allocated or employed in Oklahoma. INCOME TAX GENERAL INSTRUCTIONS FOR DETERMINING OKLAHOMA TAXABLE INCOME INCOME COMPUTATION. The use of the correct corporate name and.

Mail Form 504-C Application for Extension of Time to File an Oklahoma Income Tax Return for Corporations Partner-ships and Fiduciaries with. Virtue of powers and privileges acquired by the nature of all organizations falling within the purview of the Franchise Tax Code. File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S.

The maximum amount of franchise tax that a corporation may pay is 2000000. Oklahoma levies a franchise tax on all corporations or associations doing business in the state. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825 of Form.

Instructions for completing Form 512-S Form 512-S. Oklahoma franchise excise tax is levied and assessed at the rate of 125 per 100000 or fraction thereof on the amount of capital allocated or employed in Oklahoma. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return.

INCOME TAX GENERAL INSTRUCTIONS FOR DETERMINING OKLAHOMA TAXABLE INCOME INCOME COMPUTATION. Online Filing Oklahoma Taxpayer Access Point OkTAP makes it easy to file and pay. Item FItem F Place an ÒXÓ in the box if any of the preprinted information is incorrect.

2020 Oklahoma Small Business Corporation Income and Franchise Tax Forms and Instructions. If filing a stand-alone OklahomaAnnual Franchise Tax Return Form 200 do not use this form to remit franchise tax. Oklahoma franchise excise tax is levied and assessed at the rate of 125 per 100000 or fraction thereof on the amount of capital allocated or employed in Oklahoma.

These elections must be made by July 1. When submitting the Franchise Tax Return foreign corporations must pay a 100 registered agensts fee. Small Business Corporation Income Tax form Form 512-S-SUP.

While all corporations must file a report with the Secretary of State those with. Applications for refunds must include copies of your related Oklahoma Income Tax Returns. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now.

Ad Fill Sign Email OK Form 200 More Fillable Forms Register and Subscribe Now. You must also disclose the value of. Supplemental Schedule for Form 512-S Part.

All Foreign non-Oklahoma Corporations including non-profits must pay an Annual Registered Agent Fee of 10000. Prepare and file your Oklahoma Annual Franchise Tax. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax Forms Publications Forms - Business Taxes Forms - Income Tax Publications.

2020 Oklahoma Small Business Corporation Income and Franchise Tax Forms and Instructions. Indicate this amount on Line 13 of the Form 200. The remittance of estimated franchise tax must be made on a tentative estimated franchise tax return Form 200.

To make this election file Form 200-F. The amount must be either zero 0 or the maximum 2000000 tax. INCOME TAX GENERAL INSTRUCTIONS FOR DETERMINING OKLAHOMA TAXABLE INCOME INCOME COMPUTATION.

Oklahoma Tax Commission Franchise Tax PO. Property owned is the book value of the assets. Tax Worksheet The basis for computing your tax is the balance sheet as shown by your books.

Prepare and file your balance sheet and Schedules B C D of your annual return. Information and your payment payable to the Oklahoma Tax Commission for any applicable tax interest penalty reinstatement fee or registered agents fee. Corporations are taxed 125 for each 1000 of capital invested or otherwise used in Oklahoma up to a maximum levy of 20000 foreign corporations are assessed an additional 100 per year.

Acquired by the nature of all organizations falling within the purview of the Franchise Tax Code. Effective November 1 2017 corporations who remit the maximum amount of 2000000 in the preceding tax year the tax will be due and payable on May 1st of each year and delinquent if not paid on or before June 1st. Franchise Tax If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax.

Complete the Oklahoma Annual Franchise Tax Return Item DItem D Place an ÒXÓ in the box if you are incorporated in the State of Oklahoma. Specific Line Instructions Line 1 Tax Enter the amount computed from your worksheet. Return due date is January 1 2008 or later - If your capital was 200000 or less the minimum tax is zero.

Visit us at wwwtaxokgov to file your Franchise Tax Return. Item EItem E Place an ÒXÓ in the box if you incorporated in a state other than Oklahoma. These are the steps business owners must take in order to file their franchise tax return.

LINE BY LINE INSTRUCTIONS. Oklahoma franchise excise tax is levied and assessed at the rate of 125 per 100000 or fraction thereof on the amount of capital allocated or employed in Oklahoma. When a corporations franchise tax.

Box 26930 Oklahoma City OK 73126-0930. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual. The franchise tax is calculated at the rate of 125 for each 100000 of capital employed in or apportioned to Oklahoma.

LINE BY LINE INSTRUCTIONS. The rules legislation and appropriations related to taxes and incentives are very dynamic and as changes occur this Tax Guide will be updated. Only those corporations with capital of 20100000 or more are required to remit the franchise tax.

Line 2 Registered Agent Fee If your corporation originated in a state other than Oklahoma the Secretary of State of Oklahoma charges an annual registered agent fee of 10000. OKLAHOMA BUSINESS INCENTIVES AND TAX GUIDE FOR FISCAL 1 Welcome to the 2021 Oklahoma Business Incentives and Tax Information Guide.

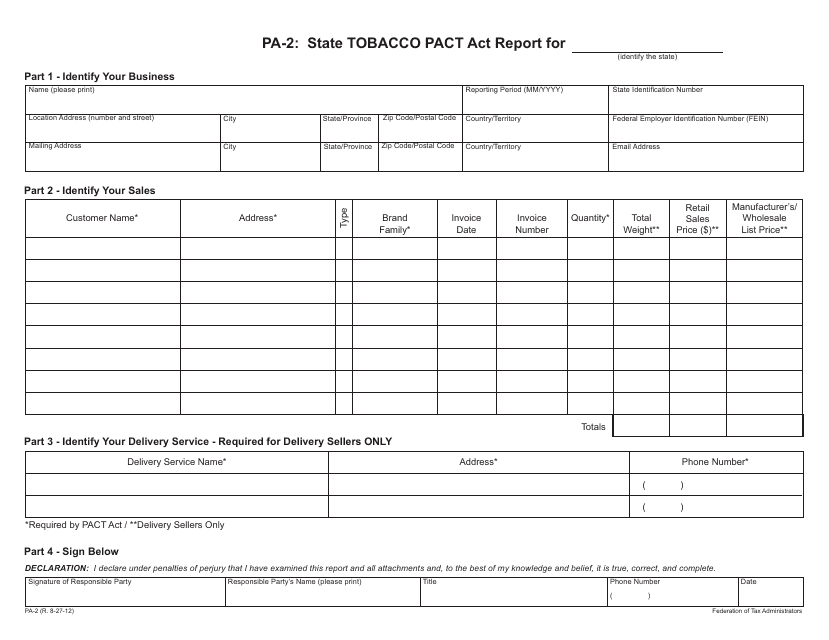

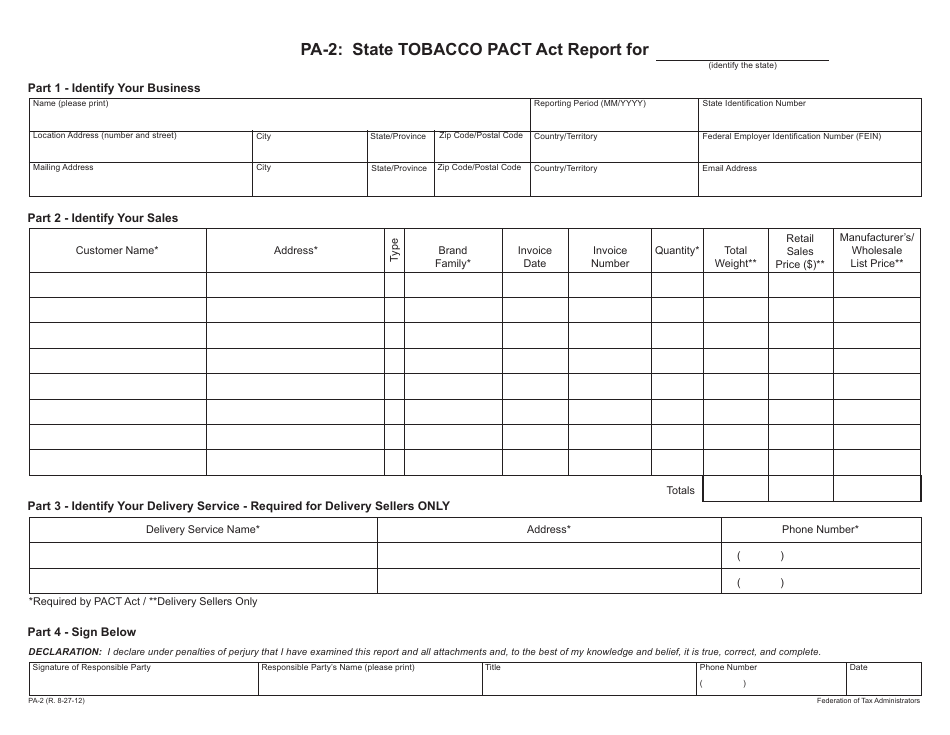

Otc Form Pa 2 Download Printable Pdf Or Fill Online State Tobacco Pact Act Report Oklahoma Templateroller

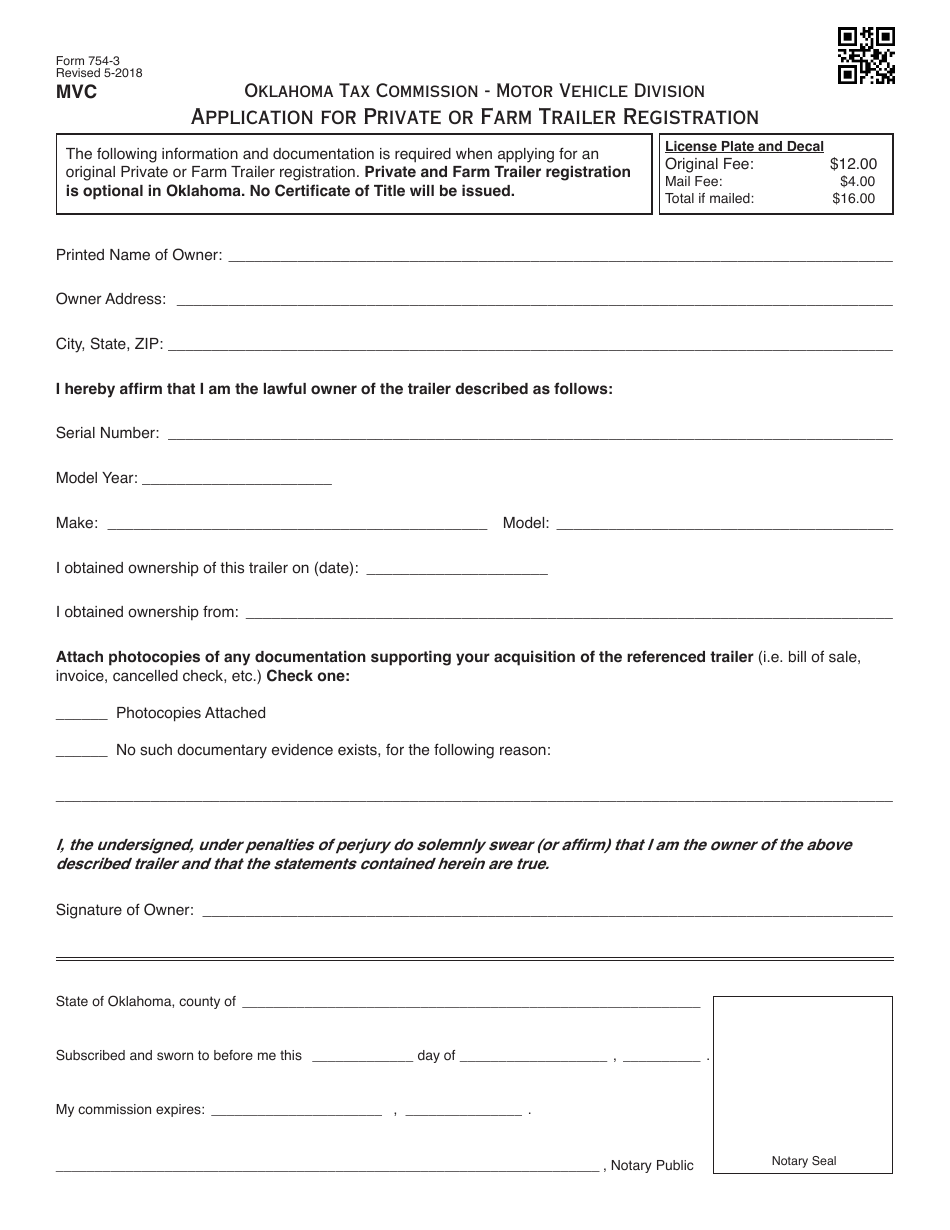

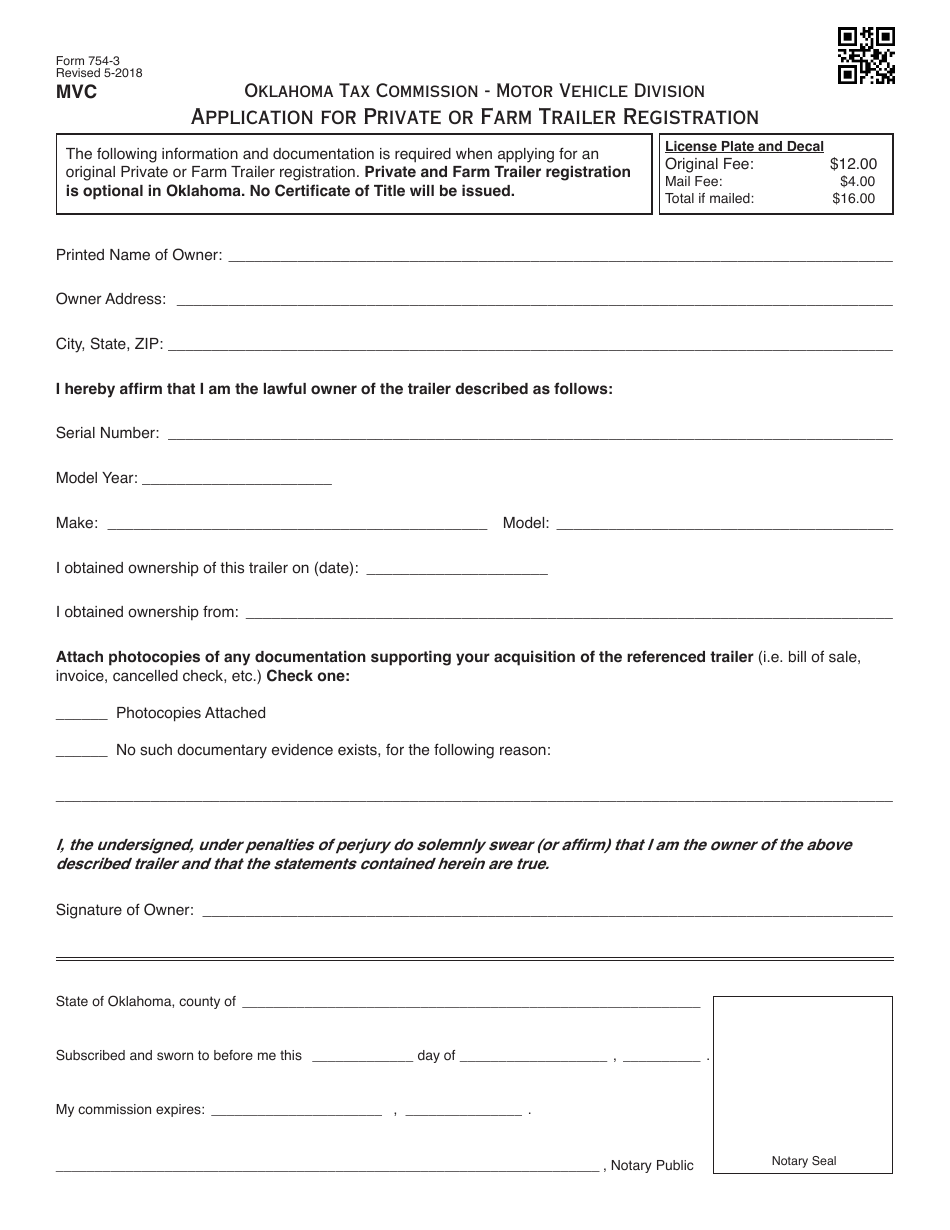

Otc Form 754 3 Download Fillable Pdf Or Fill Online Application For Private Or Farm Trailer Registration Oklahoma Templateroller

The New U S Tax Deadlines For 2020 Covid 19 Bench Accounting

Otc Form Pa 2 Download Printable Pdf Or Fill Online State Tobacco Pact Act Report Oklahoma Templateroller

Form 540 Fill Online Printable Fillable Blank Pdffiller

Oklahoma Business Registration How To Register A Business In Oklahoma

Otc Form 754 3 Download Fillable Pdf Or Fill Online Application For Private Or Farm Trailer Registration Oklahoma Templateroller

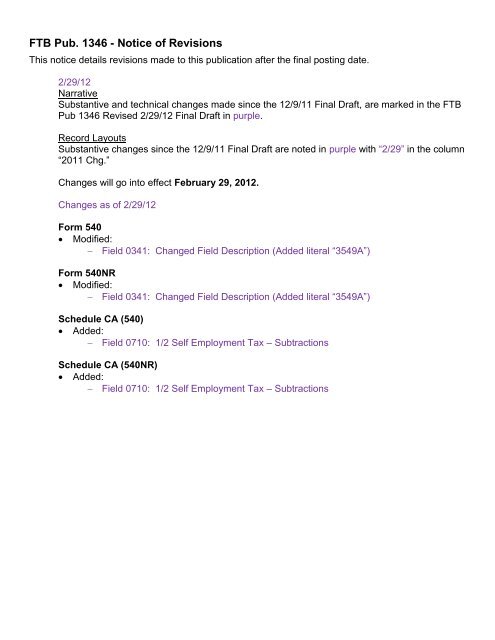

Ftb Pub 1346 California Franchise Tax Board State Of California